open end lease accounting

Ad See the Accounting Tools your competitors are already using - Start Now. This will be the recorded cost of the asset.

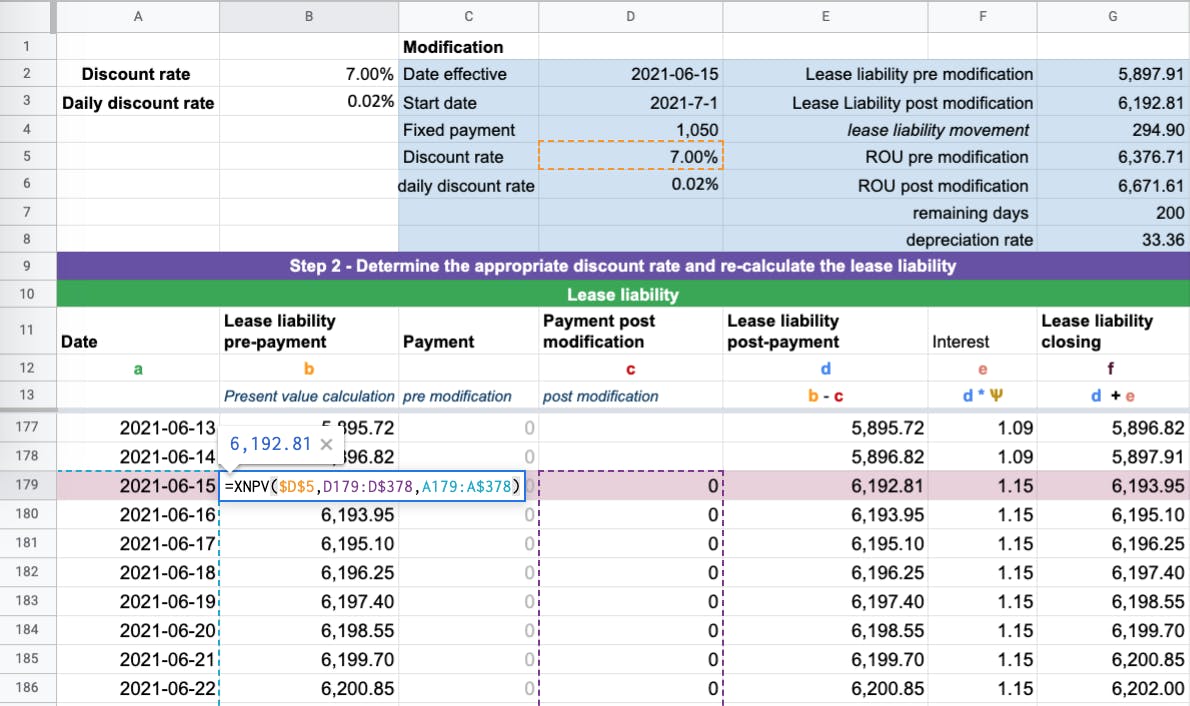

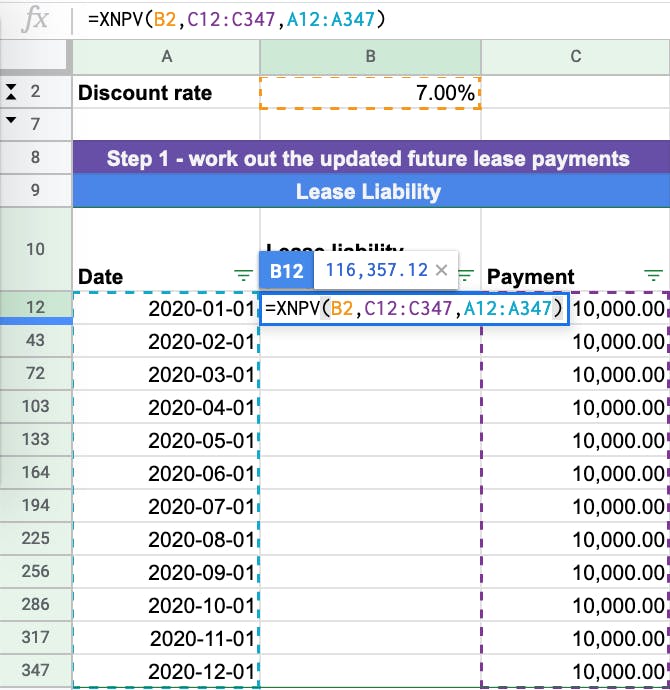

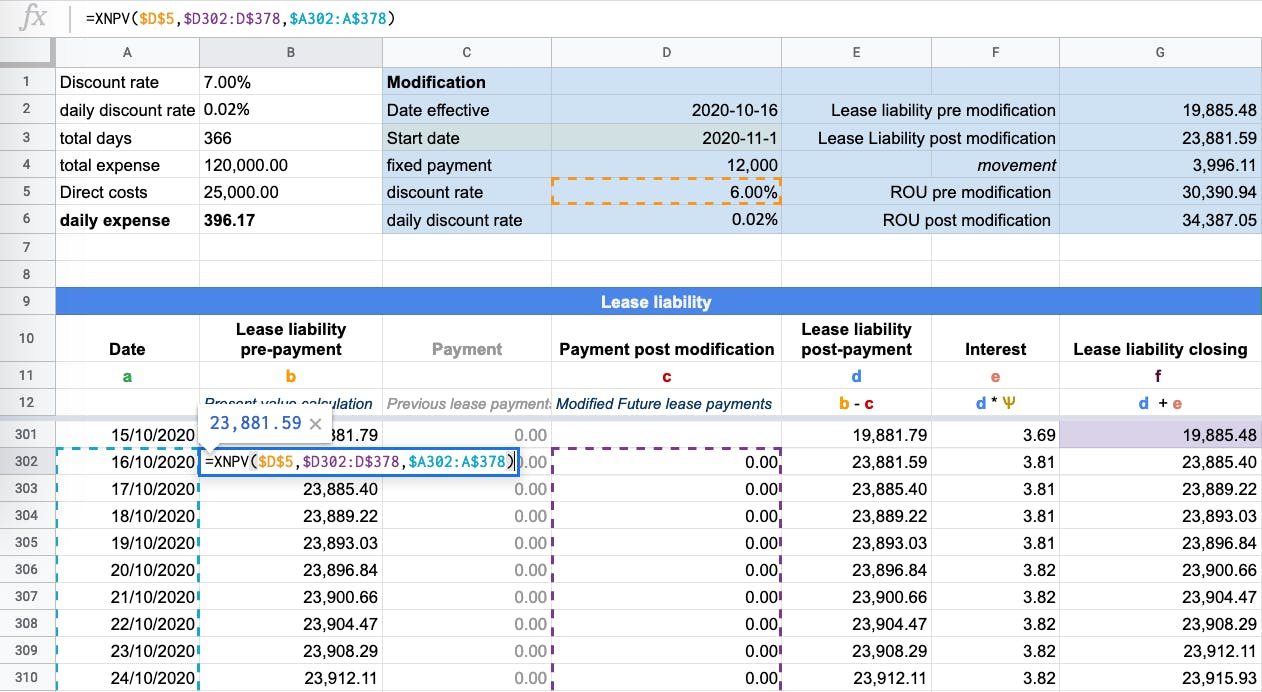

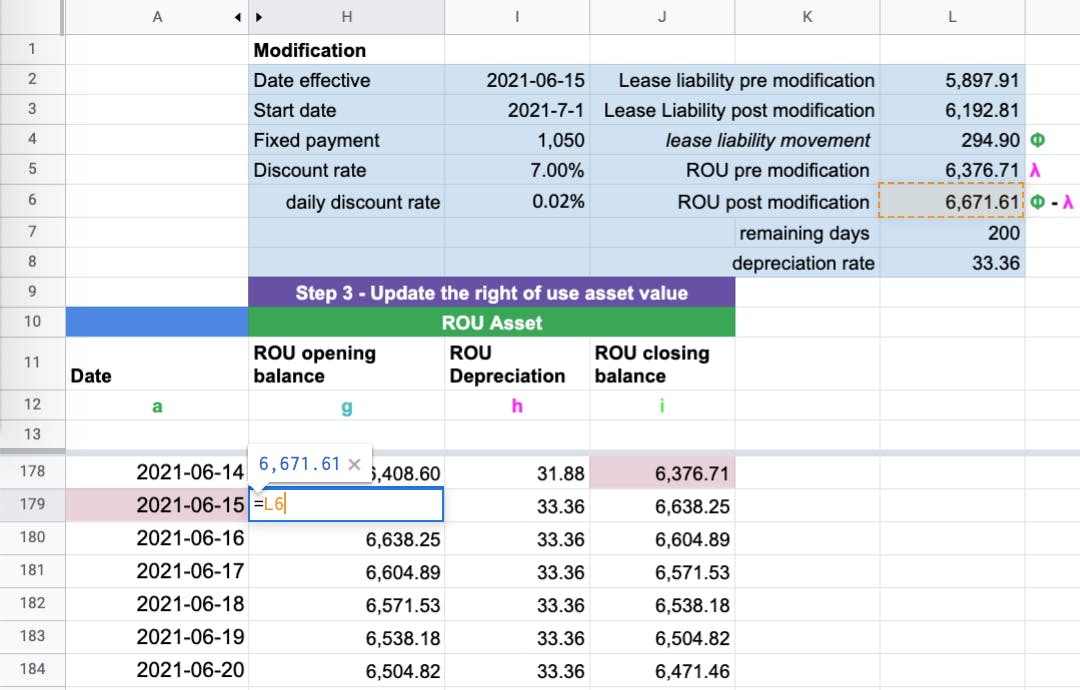

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

The open-end lease bill breaks down the monthly depreciation management fee interest and taxes.

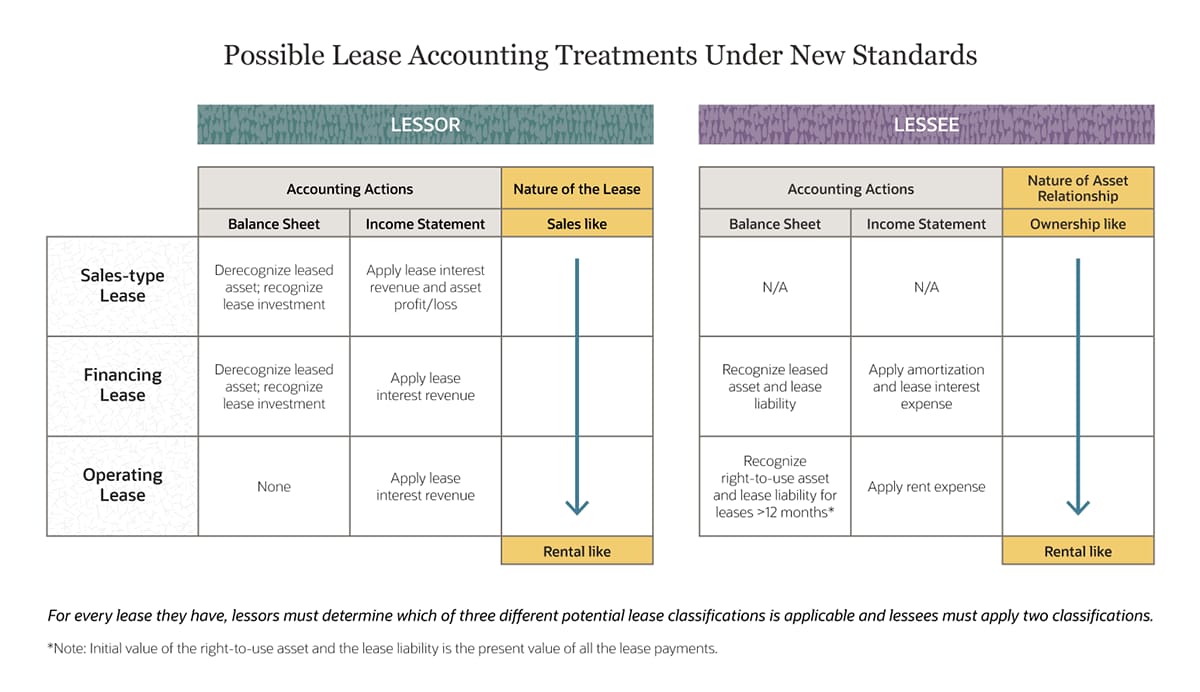

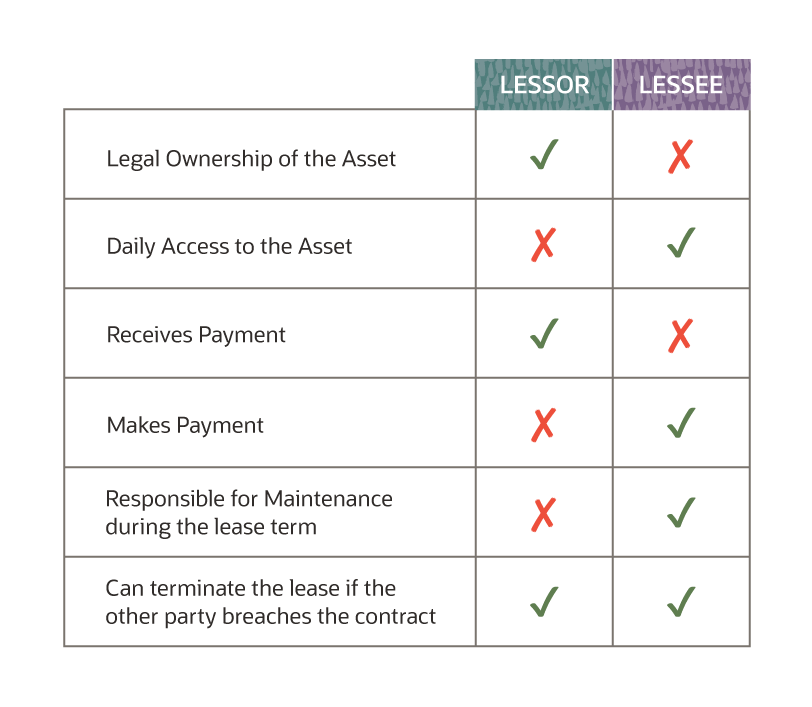

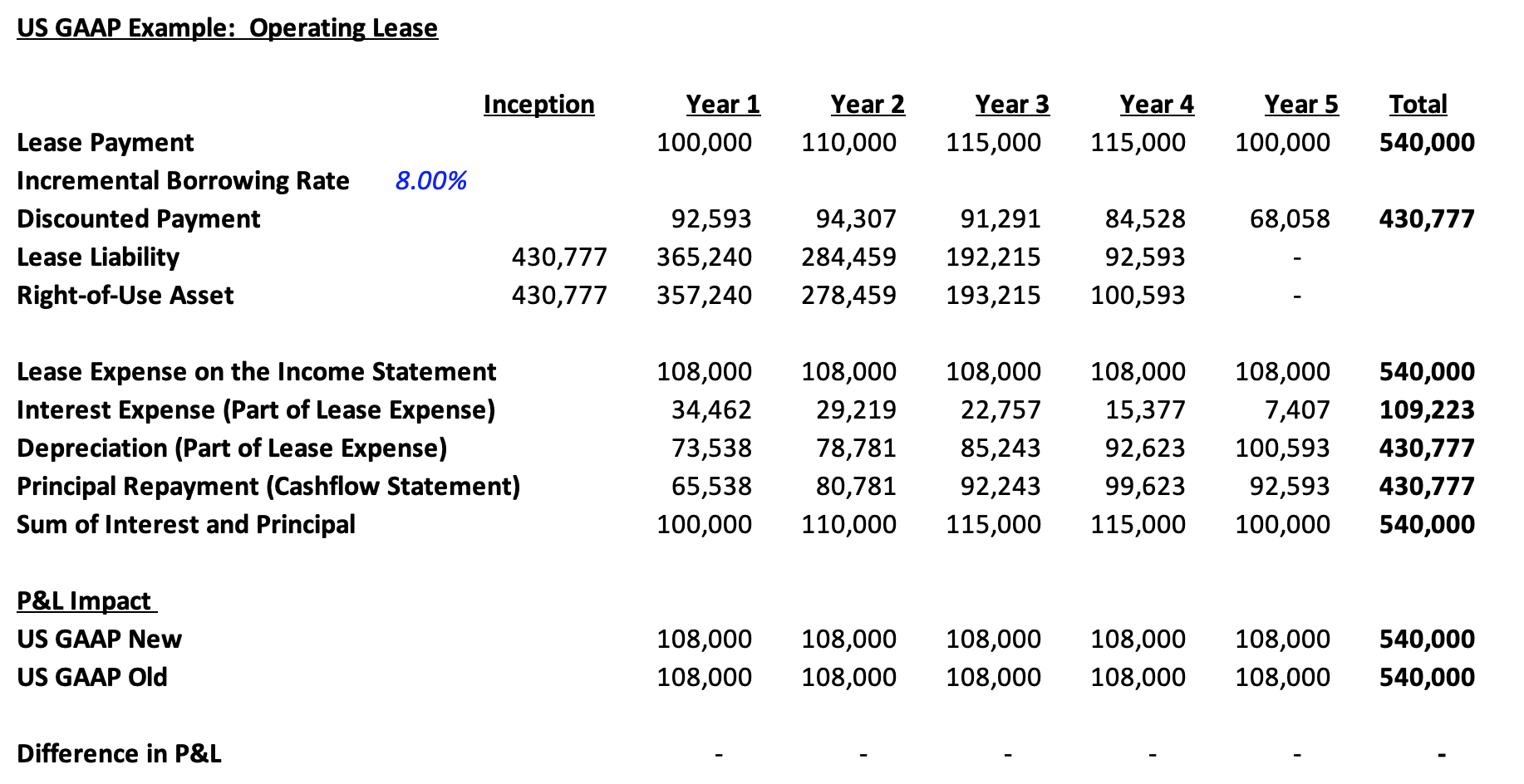

. Get Products For Your Accounting Software Needs. Operating Lease Accounting Example 3. The accounting for an operating lease assumes that the lessor owns the leased asset and the lessee has obtained the use of the underlying asset only for a fixed period of.

Ad Browse Discover Thousands of Business Investing Book Titles for Less. Lets say your lease payments. GetApp has the Tools you need to stay ahead of the competition.

The lease term comprises at least 75 of the useful life of the asset. Calculate the present value of all lease payments. Open End Lease TRAC Leasing If youre looking for a way to add vehicles to your fleet with greater flexibility you may want to consider a Terminal Rental Adjustment Clause TRAC.

The open-end finance lease which in most cases has either an addendum or a modification to. Ad Get Complete Accounting Products From QuickBooks. To help you better understand open-ended leases were inclined to provide an example to better illustrate how this type of lease works.

At the end of the lease period. What is Open-End Lease. The lease contract usually a car or means of transport in which payable payments completely debt.

This position will have a hybrid schedule and will be. End-of-term options which are often drafted on separate forms generally determine the accounting and tax treatment of a lease for both the lessor and the lessee. Let us take the example of a company that has entered into an operating lease agreement for three years with an initial lease payment of.

An open-end lease has more flexible terms and the lessee takes on the depreciation risk of the asset. Ad Get Complete Accounting Products From QuickBooks. Record the amount as a debit to the appropriate fixed asset account and a credit to.

GFOA Advisories identify specific policies and. Century Group has partnered with a client in the downtown LA area who is searching for a Manager Open End Fund Accounting. An entity can make an accounting policy election to treat operating leases with a lease term of 12 months at transitionlease commencement and which does not have a.

Monthly payments are usually lower than the grant. Get Products For Your Accounting Software Needs. Accounting for Leases Identify locate review assess and communicate various aspects relevant to agreements leases and contracts.

They normally involve portable or mobile equipment that is clearly not special purpose to the. Open-end leases are generally blanket or master leases with multiple takedowns of equipment. 100s of Top Rated Local Professionals Waiting to Help You Today.

The lessee can buy an asset at the end of term at a value below market price. An open-end loan is a preapproved loan between a financial institution and a borrower that can be used repeatedly up to a certain limit and then paid back before payments. In a closed-end lease the lessor takes on the depreciation.

Monthly payment amounts vary usually stepping down year-over-year as. CALIFORNIA NEW CAR DEALERS ASSOCIATION DEALER MANAGEMENT GUIDE 16th EDITION By Manning Leaver Bruder Berberich Attorneys Los Angeles California California.

Accounting For Leases The Marquee Group

-A-Guide-for-Tech-Com/Tech_Lease-Accounting-Guide_brochure_10-18_webcharts1.png.aspx)

Lease Accounting A Guide For Tech Companies Bdo Insights

How To Calculate The Lease Liability And Right Of Use Rou Asset For An Operating Lease Under Asc 842

Lease Accounting Calculations And Changes Netsuite

How To Calculate The Lease Liability And Right Of Use Rou Asset For An Operating Lease Under Asc 842

How To Calculate The Journal Entries For An Operating Lease Under Asc 842

What Is Lease Accounting Expert Guide Examples Netsuite

Open Vs Closed End Leases What To Know Credit Karma

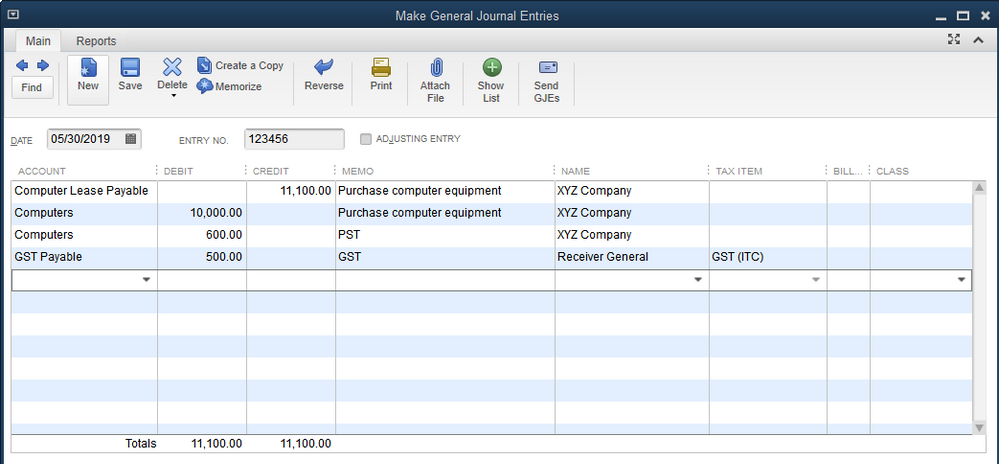

Solved How To Record Lease To Own Computer Asset

What Is Lease Accounting Expert Guide Examples Netsuite

Accounting For Leases The Marquee Group

How To Calculate The Lease Liability And Right Of Use Rou Asset For An Operating Lease Under Asc 842

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

:max_bytes(150000):strip_icc()/GettyImages-912785590-bd21254b8f914ad1a28876e45800554c.jpg)